Most equipment has a limited lifespan. For example, a machine purchased 15 years ago will likely break down more frequently than newer equipment or stop working altogether. And when the cost of repairing that machine no longer makes financial sense, it will need to be replaced. In other words, the asset’s useful life will end.

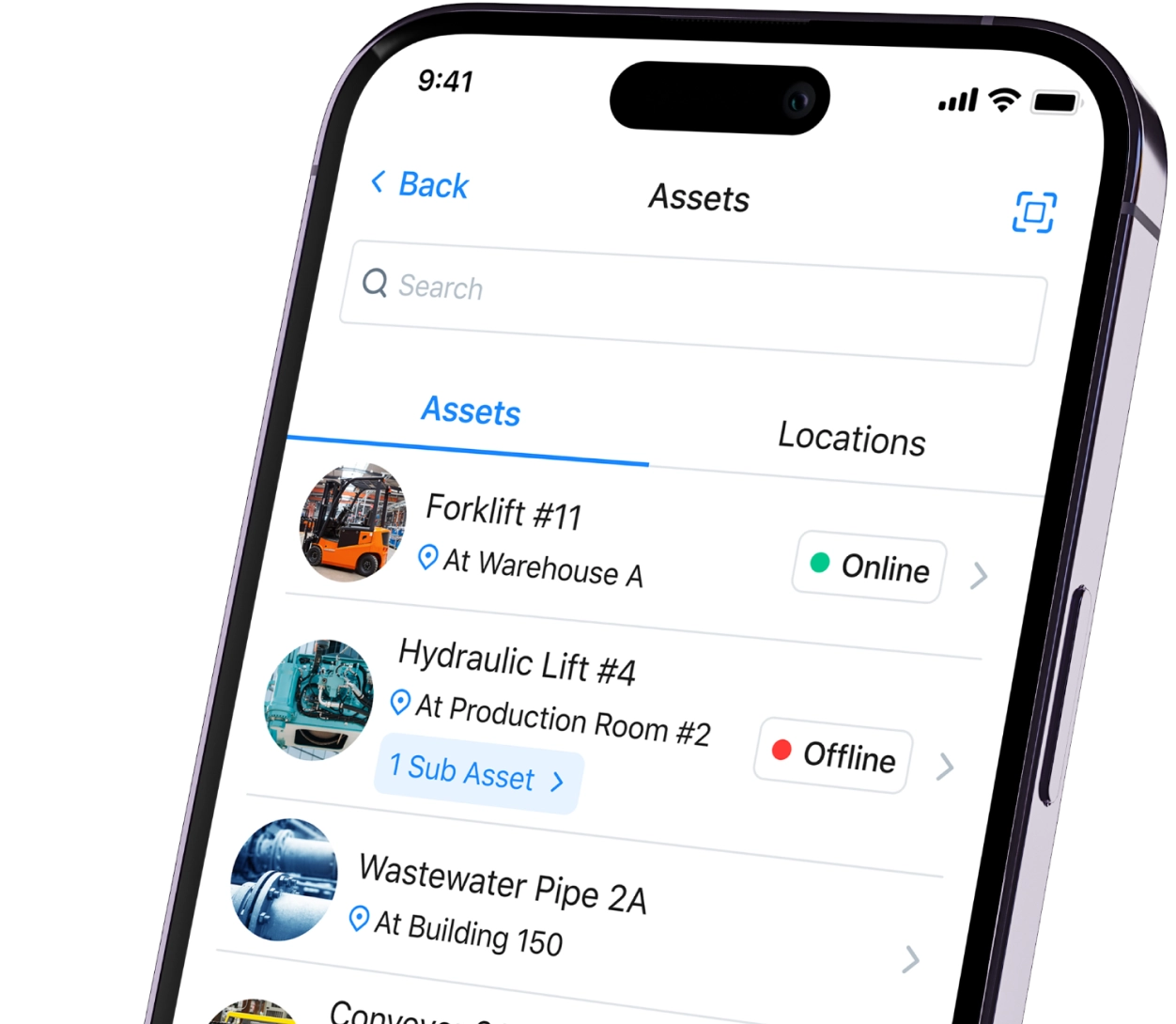

The useful life of an asset is helpful for planning maintenance and taxes. You can use asset management and maintenance strategies to get the most out of your asset while it’s in service. Using CMMS software with robust reporting and analytics features helps you track an asset’s performance metrics so you can increase its useful life without incurring high costs.

What Is the Useful Life of an Asset?

The useful life of an asset is the estimated number of years an asset will remain in service while generating financial value.

The definition might sound a little complex, but the meaning of useful life is fairly simple. It’s the period of time during which a machine can provide more benefits than the cost of the maintenance and repairs it demands. However, the useful life of the asset is not the same as its actual life.

For instance, say machine A was purchased 10 years ago for $50,000. Over the past six months, the machine broke down four times. The repair costs totaled $10,000.

Does it make financial sense to continue using the machine? Not quite. Is the machine still usable? Absolutely.

How to Calculate the Useful Life of an Asset

The useful life can be estimated based on the IRS Publication 946, Appendix B, asset history, asset condition when purchased, manufacturer’s specifications, quality of maintenance, and climate. We discuss these below.

1. Refer to The IRS Publication

IRS Publication 946, Appendix B, contains useful life estimates for assets for almost every industry and application.

2. Asset History

How long do similar machines last, given the manufacturing process? For example, if the previous machine lasted 10 years, it’s a reasonable estimate for the useful life of the next machine. If there are any factors that might give the machine a longer estimated useful life, such as using a different material for construction, factor that into the calculation for useful life.

3. Asset Condition at The Time of Purchase

New business assets last longer than used assets. Note that calculating the useful life of old assets requires extra thought. You should consider the following when estimating the useful life of older, or previously used, assets:

- Age of the asset

- Quantity of goods produced by the machine

- Asset maintenance by the previous owner

- Major repairs in the past

4. Manufacturer Specifications

Looking at asset history isn’t an option when investing in new equipment. However, the manufacturer may be able to provide information here based on its experience with other clients.

Useful life is often expressed in terms of total production or the number of hours. For instance, suppose the manufacturer specifies the asset’s useful life as 2 million units. If the annual production requirement is 200,000 units, the machine’s useful life is calculated to be 10 years.

5. Quality of Maintenance

Poorly maintained assets are more likely to break down and require repairs. Reactive maintenance results in faster wear and tear, shortening the asset’s useful life. Therefore, investing in the timely maintenance of assets has considerable benefits in terms of useful life.

According to industry experts, companies should aim for 80% preventive maintenance and only 20% reactive maintenance. Computerized maintenance management systems, like MaintainX, automate preventive maintenance scheduling to help move toward 80:20 maintenance planning.

“The ability to monitor working equipment to estimate when maintenance should happen is a competitive advantage. Rather than waiting for equipment to fail or relying on a time-based approach, manufacturers connect with assets in real-time to prevent unplanned downtime.”

Capgemini

6. Climate

Depending on where a company is located, climate can impact an asset’s useful life. Units located in areas with a lot of humidity can see their assets rust faster, shortening their service life. An asset’s life is also relatively shorter when used in areas where extremely high temperatures and flooding are common.

Useful Life and Depreciation

There are multiple indicators of an asset’s useful life. But which one is most appropriate?

The short answer is that it depends.

For instance, the practical useful life is crucial input for an Enterprise Asset Management (EAM) system. Accurate information in the system can help the maintenance team with asset lifecycle management.

On the other hand, the useful life used in your tax books should be according to the IRS. And this is where depreciation comes into the picture.

According to Investopedia, asset depreciation refers to “an accounting method used to allocate the cost of a tangible or physical asset over its useful life.” As the piece of equipment depreciates, the maintenance and repair cost of an asset will increase.

When a company purchases an asset, it’s not shown as an expense and, therefore, doesn’t reduce the company’s profit. Instead, the cost of the asset is subtracted from the profit (i.e., expensed in the income statement as depreciation) over its useful life as per the norms set by the IRS.

The IRS states the number of years that an asset can be depreciated over, the depreciation method, and the rate of depreciation. The amount of depreciation expense appears on the income statement until the asset is written off the books (i.e., at the end of its useful life).

For instance, if the IRS prescribes the straight-line method for Asset X (cost = $100,000) and an asset life of 10 years, the annual depreciation will be $10,000 per year. As a result, the company will reduce its profit by $10,000 each year for 10 years, at which point the asset will disappear from the books.

Asset Cost ÷ Asset Life = Depreciation

$100,000 ÷ 10 years = $10,000 depreciation/year

Essentially: Shorter useful life = higher annual depreciation expense = lower profit = smaller tax bill.

Example of Calculating an Asset’s Useful Life

ABC Corporation purchases Machine A for $60,000. ABC Corporation’s asset management team estimates the remaining useful life of the new machine, Machine A, to be 15 years based on its previous experience with the same model of machine.

$60,000 ÷ 15 years = $4000/year

Should ABC Corporation assume 15 years as the machine’s useful life? This makes logical sense, and Machine A may provide service for 15 years. First, however, it’s essential to consider what the IRS thinks the asset’s useful life should be.

The IRS’s list can have a tangible impact on taxes. For instance, say the IRS lists Machine A’s class life as 12 years under the General Depreciation System (GDS), and 15 years under the Alternate Depreciation System (ADS). If ABC Corporation chooses the ADS method, it will end up with a bigger tax bill.

Get a CMMS to Help Plan Your Maintenance

A CMMS allows maintenance teams to create work order templates in advance and assign tasks when maintenance needs arise. The software helps busy managers track, plan, and operationalize maintenance activities and analyze failure data.

Check out MaintainX for asset maintenance history tracking. It’s free.

Determine the Useful Life of an Asset FAQS

What is The Straight-Line Depreciation Method?

The Straight-Line Depreciation Method is one of the most straightforward and commonly used techniques for allocating the cost of a tangible asset over its useful life. This method evenly spreads the depreciation expense across each period of the asset's useful life, resulting in a consistent reduction in the asset's book value.

How Can Technological Advancements Help Determine the Useful Life of an Asset?

Technological advancements offer several ways to enhance how businesses determine the useful life of an asset. Tools like depreciation calculators help businesses gain deeper insights into the condition and performance of their fixed assets, leading to more accurate assessments of useful life and better-informed decisions about maintenance, repairs, and replacement. Through technological advancements, businesses can better optimize their asset management strategies for improved efficiency and financial planning.

What Are the Economic Benefits of Determining the Useful Life of an Asset?

Determining the useful life of an asset can bring several economic benefits to a business. Here are some of the key economic advantages:

- Accurate financial statements

- Improved budgeting and forecasting

- Optimized maintenance and repair costs

- Enhanced ROI assessment

- Lower total cost of ownership

- Reduced risk of overvaluing or undervaluing assets

- Compliance with accounting standards

- Enhanced asset management strategy

- Improved cash flow management

Caroline Eisner

Caroline Eisner is a writer and editor with experience across the profit and nonprofit sectors, government, education, and financial organizations. She has held leadership positions in K16 institutions and has led large-scale digital projects, interactive websites, and a business writing consultancy.

See MaintainX in action